CFO Partnership to address your most critical business needs

Every successful entrepreneur needs a financial partner who can navigate complex challenges and drive strategic growth alongside them.

Foundry CFO Partners provide valuable expertise to transform your financial operations, optimize performance, and position your business for the next level.

With a fractional CFO as your strategic ally, you can focus on what you do best while having confidence that your financial foundation is driving you toward your biggest business goals.

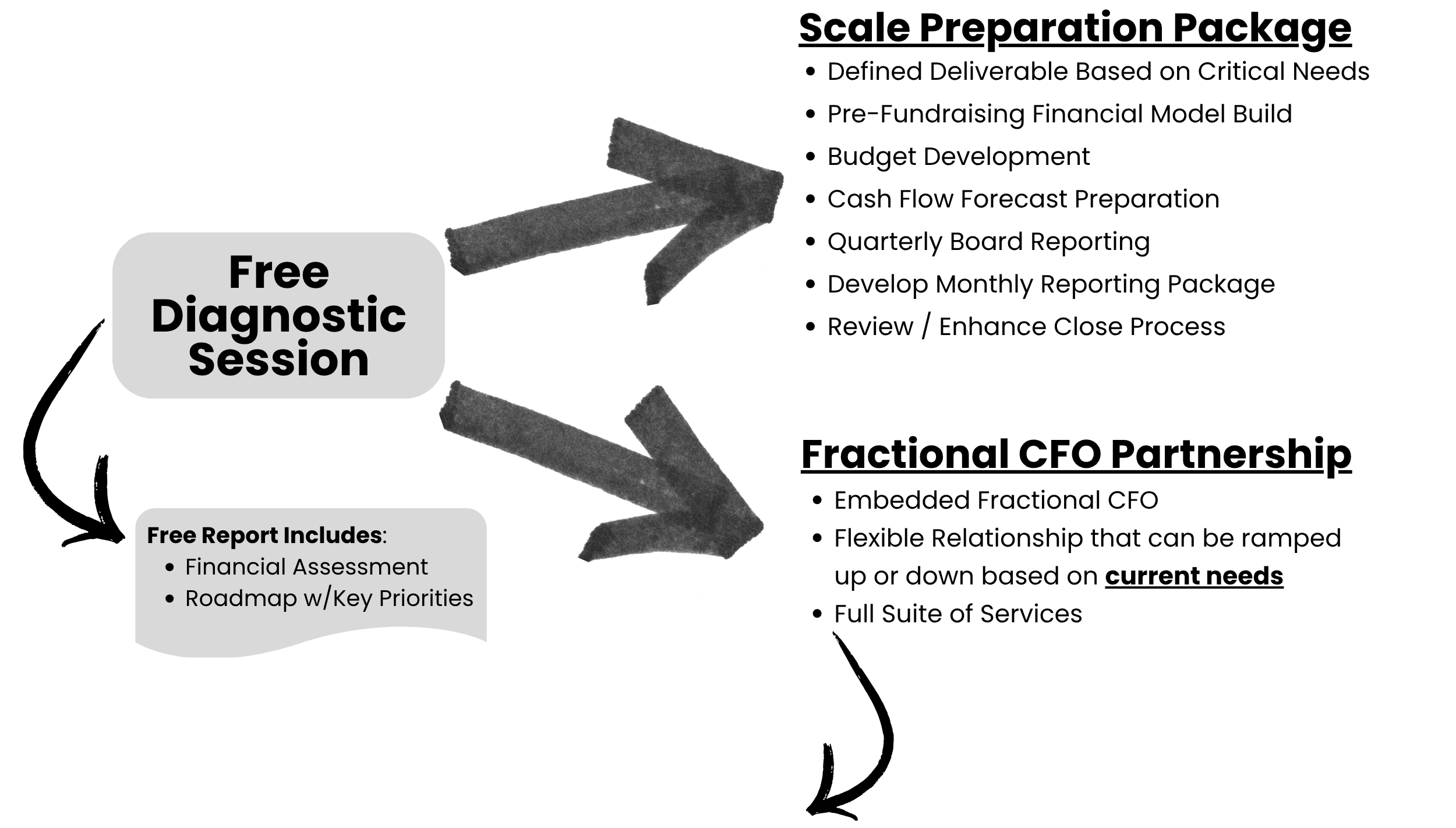

How it works

Outsourced CFO Services

-

Business model development & optimization

Growth strategy & scaling planning

Budget creation & management

Exit planning & preparation

Board & investor presentation support

Scenario planning & modeling

-

Fundraising strategy & support

Investor pitch deck development

Financial due diligence preparation

Debt financing support

-

Cash flow forecasting & management

Working capital optimization

Cash runway analysis

-

Accounting system optimization

Month-end close and reporting enhancement

KPI dashboard and reporting development

Finance function management and optimization

-

Monthly financial reporting development

Variance analysis - budget vs actual analysis

Unit economics analysis

Financial model enhancement

-

Pricing strategy development

Cost reduction initiatives

Vendor negotiations

Financial policy development

-

Risk assessment & mitigation

Insurance review

Regulatory compliance

Internal control design

How Foundry CFO Partners can transform your business

Executive Financial Leadership Without Full-Time Cost

Hiring a full-time CFO can cost $200,000-$400,000+ annually—an impossible expense for most early-stage companies. A Fractional CFO delivers the same strategic expertise at a fraction of the cost, typically 20-40% of a full-time salary. You get seasoned financial leadership exactly when you need it, allowing you to invest more capital in product and customer acquisition.

Cash Flow Mastery and Runway Extension

Running out of cash is the number one reason startups fail, but a Fractional CFO ensures you always know your runway. They implement cash flow forecasting, identify cost-saving opportunities, and help you prioritize spending for maximum impact. This financial discipline can extend your runway by months, giving you breathing room to achieve critical milestones.

Strategic Financial Planning for Growth

Our team can help translate your vision into actionable financial roadmaps that fuel sustainable growth. They build detailed forecasts, scenario models, and budgets that help you make confident decisions about hiring, spending, and scaling. This strategic foundation gives you clarity on when and how to accelerate growth.

Data-Driven Decision Making Framework

We transform raw financial data into actionable insights that guide your most important business decisions. They establish key metrics and dashboards tailored to your business model, giving you visibility into unit economics, CAC, LTV, and other critical KPIs. This data-driven approach replaces gut feelings with evidence, reducing costly mistakes.

Investor-Ready Financial Operations

Raising capital requires more than a great pitch—investors demand clean financials, realistic projections, and solid unit economics. Foundry CFOs will prepare you for due diligence by establishing proper accounting systems and building credible models that stand up to scrutiny. This preparation dramatically increases your chances of closing rounds at favorable terms.

Operational Efficiency and Process Building

A Fractional CFO builds the financial infrastructure your company needs to scale efficiently. They implement proper accounting systems, establish internal controls, and create repeatable processes that prevent chaos as you grow. You'll spend less time fixing financial messes and more time building your business.